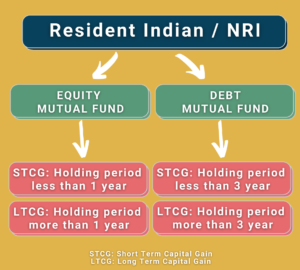

First, let us understand what are the factors that determine Mutual Fund Taxation. The three major parts of these are below.

-

Your Residential Status-Resident or Non-Resident (NRI)

Your tax will be based on your residential status. If you are a resident then the taxation rules will be different and if NRI then it differs. Hence, first, you have to make sure of your residential status.

-

Types of Funds-Equity Funds or Non-Equity Funds-

Any fund which invests 65% or more in equity is called an Equity Fund. For example, large-cap funds, multi-cap funds, small and mid-cap funds, or equity-oriented balanced funds (where the equity exposure is 65% or more) are all called equity-oriented funds.

If the equity portion is less than that, then they are all treated as debt funds or non-equity funds. For example liquid funds, ultra-short-term funds, short-term funds, income funds, gilt funds, debt-oriented balanced funds, gold funds, funds of funds or money market funds.

-

Holding periods of Investment–

The holding period for Equity and Debt Funds will be different for taxation purposes. For equity funds, if the holding period is more than a year, then it is called the long term. If the holding period is less than a year, then such an equity mutual funds holding period is considered a short term. Whereas in

Whereas in the case of debt funds, a holding period of more than 3 years is considered as long-term. If the holding period of debt funds is less than 3 years, then it is considered short-term and taxed accordingly.

I will try to explain the same from the chart below.

The Capital Gain Mutual Fund Taxation FY 2021-22 / AY 2022-23 will be as per the below table.

|

Individuals |

NRI | |

|

Stocks & equity oriented Mutual Funds |

||

| LTCG | 10% above Rs 1 lakh gain | 10% above Rs 1 lakh gain |

| STCG | 15% | 15% |

|

Other than Stocks & equity oriented Mutual Funds |

||

| LTCG | 20% with indexation | Listed 20% (with indexation) & unlisted 10% (without indexation). |

| STCG | Based on individual slabs | Based on individual slabs |

There is no change in Capital Gain Tax Rates from last year. Hence, the old rates will be applicable for FY 2021-22 also.

Note-Surcharge @ 15%, is applicable where the income of Individual/HUF unit holders exceeds Rs. 1 crore. Also, surcharge @10% to be levied in case of individual/ HUF unitholders where the income of such unitholders exceeds Rs.50 lakhs but does not exceed Rs.1 Cr. Further, Health and Education Cess @ 4% will continue to apply on the aggregate of tax and surcharge.

As you may be aware that during Budget 2018, LTCG was introduced again to Equity Funds. Hence, let me explain the same on how to calculate the LTCG on Equity Funds as below.

|

How to calculate LTCG on tax slabs & Equity Mutual Fund? |

||

|

LTCG & STCG on Stocks & Mutual Funds (up to 31st January 2018) |

||

| Bought before 31st January 2018 | 10,000 stocks at INR 100 | |

| Sold within 365 days | 10,000 stocks at INR 130 | |

| STCG | Profit INR 130 | 15% STCG = INR 45,000 |

| Sold after 365 days | 10,000 stocks at INR 150 | |

| LTCG | Higher of a) or b)

a)Actual cost (i.e INR 100) b)Lower of the below -The highest price of 31st Jan 2018 (Rs 120) -Actual selling price (INR 150) (Assumed that the highest price on 31st Jan 2018 is INR 120) |

10% LTCG on INR 1,20,000

(10,000*Rs 120) - INR 1,00,000 INR 20,000 |

|

LTCG & STCG on Stocks & Mutual Funds(from 1st February 2018) |

||

| Buy on 1st February 2018 | 10,000 stocks at INR 100 | |

| Sold within 365 days | 10,000 stocks at INR 130 | |

| STCG | Profit INR 3,00,000 | 5% STCG = INR 45,000 |

| Sold after 365 days | 10,000 stocks at INR 50 | |

| LTCG | Profit INR 5,00,000 | LTCG = Actual profit- INR 1,00,000

=INR 4,00,000 10% LTCG on INR 4,00,000 =INR 40,000 |

Mutual Fund Taxation FY 2020-21 – Dividend Distribution Tax (DDT)

As I pointed above, effective from FY 2020-21, DDT was abolished in the hands of Mutual Fund Companies. Hence, any dividend you receive will be taxable for you as per your tax slab.

At the same time, if your such dividend income is more than Rs.5,000 in a Financial year, then there will be a TDS @ 10%.

|

Mutual Fund Taxation FY 2021-22: DDT Rates |

||

| Individual |

NRI’s |

|

|

Equity Oriented Schemes |

As per the Tax slab | As per the Tax Slab |

| Debt Oriented Schemes | As per the Tax slab |

As per the Tax slab |

Security Transaction Tax (STT) for FY 2021-22

Security Transaction Charges or STT is the charges or tax when you buy or sell securities (excluding commodities and currency) through a recognized stock exchange. Therefore,

The definition of securities involves the below products.

- Shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

- Derivatives;

- units or any other instrument issued by any collective investment scheme to the investors in such schemes;

- Security receipt as defined in section 2(zg) of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

- Government securities of equity nature;

- Rights or interest in securities;

- Equity-oriented mutual funds

Therefore, whenever you buy and sell these securities through a recognized stock exchange, then you have to pay this STT.

Now let us understand the latest Security Transaction Tax (STT) applicable for FY 2021-22.

|

Security Transaction Tax (STT) Rates for FY-2021-22 |

||

| Transaction Type | Rates |

Payable By |

| Purchase/ of equity shares (delivery Based) | 0.1% | Purchaser/ Seller |

| Purchase of units of equity-oriented mutual fund | NIL | Purchaser |

| Sale of units of equity-oriented Mutual fund

(delivery Base) |

0.001% | Seller |

| Sale of equity shares, units of business trust, units of equity-oriented mutual fund

(Non-Delivery Based) |

0.025% | Seller |

| Sale of an option in securities | 0.05% | Seller |

| Sale of an option in securities, where the option is exercised | 0.125% | Purchaser |

| Sale of future in securities | 0.01% | Seller |

| Sale of units of an equity-oriented fund to the mutual fund | 0.001% | Seller |

Sale of unlisted equity shares & units of business trust under an initial offer |

0.2% |

Seller |

TDS (Tax Deducted at Source) Rates for NRI Mutual Fund Investors 2021-22

Below are the applicable TDS rates for NRI Mutual Fund investors for FY 2021-22.

STCG Equity-The current TDS of 11.25% which was modified from 14th May 2020 to 31st March 2021 will I think continue for STCG-Equity Funds

STCG Other than Equity-The current TDS of 22.5% which was modified from 14th May 2020 to 31st March 2021 will I think continue for STCG-Other than equity.

LTCG Equity-The current TDS of 7.5% which was modified from 14th May 2020 to 31st March 2021 will I think continue for STCG-Equity Funds.

LTCG Other than Equity-The current TDS of 15% (for listed) and 7.5% (for unlisted) which was modified from 14th May 2020 to 31st March 2021 will I think continue for STCG-Other than equity.

Wealth Café Note: You pay taxes in a Mutual fund only when the gains are realized i.e. you redeem the funds and the proceeds of the same are credited to you. Now if there is a gain then the same is taxed as the taxation of mutual funds.

Hope now you got the clarity related to Mutual Fund Taxation FY 2021-22 / AY 2022-23.