We all have our aspirations and dreams for the golden years of our life. We want to have the freedom to do whatever we may want and hope to fulfill all the desires that were not fulfilled during the course of working life. It will only be possible if we have planned it well and enough funds are available to help us live our dreams. Thus, plan today for a beautiful post-retirement life.

You have been saving diligently for retirement. That's good. But in all likelihood, you have just a vague idea about what you want, not a concrete plan.

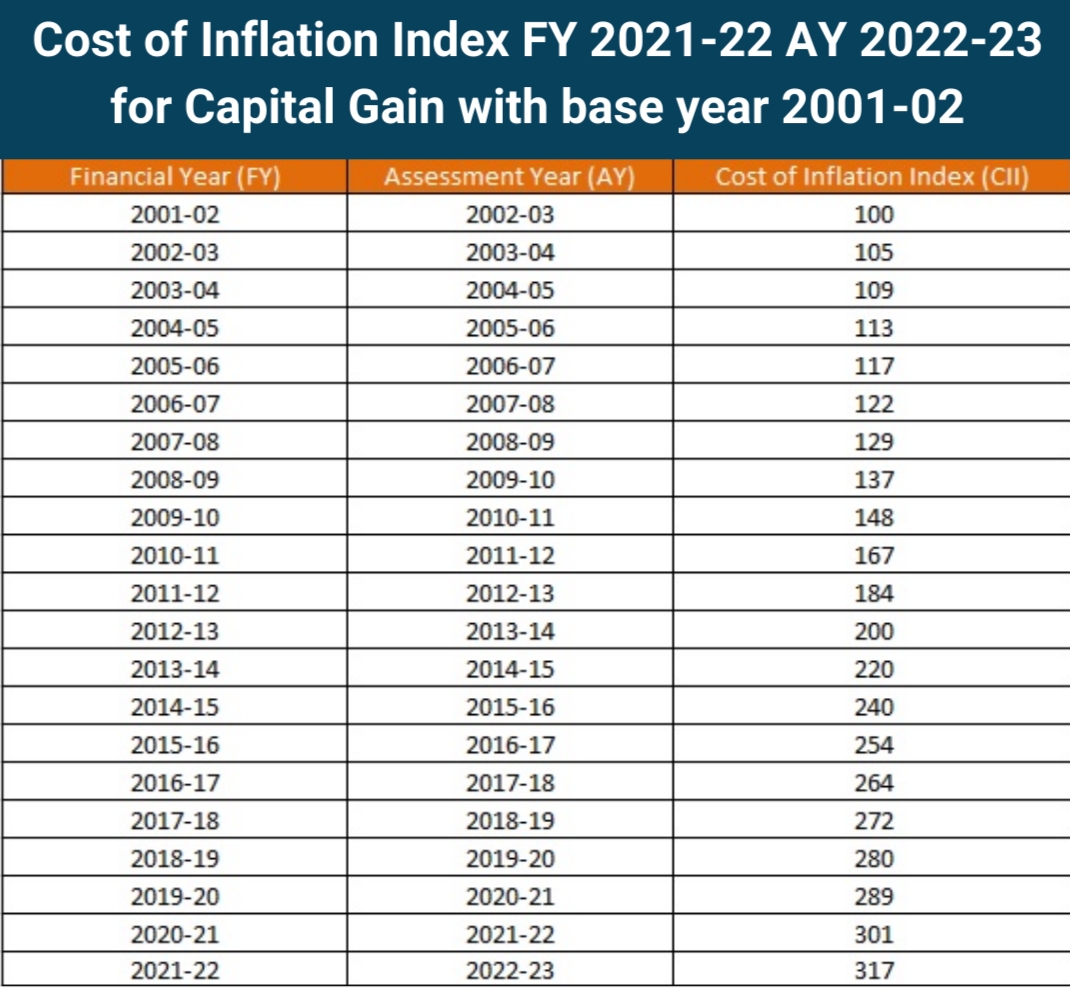

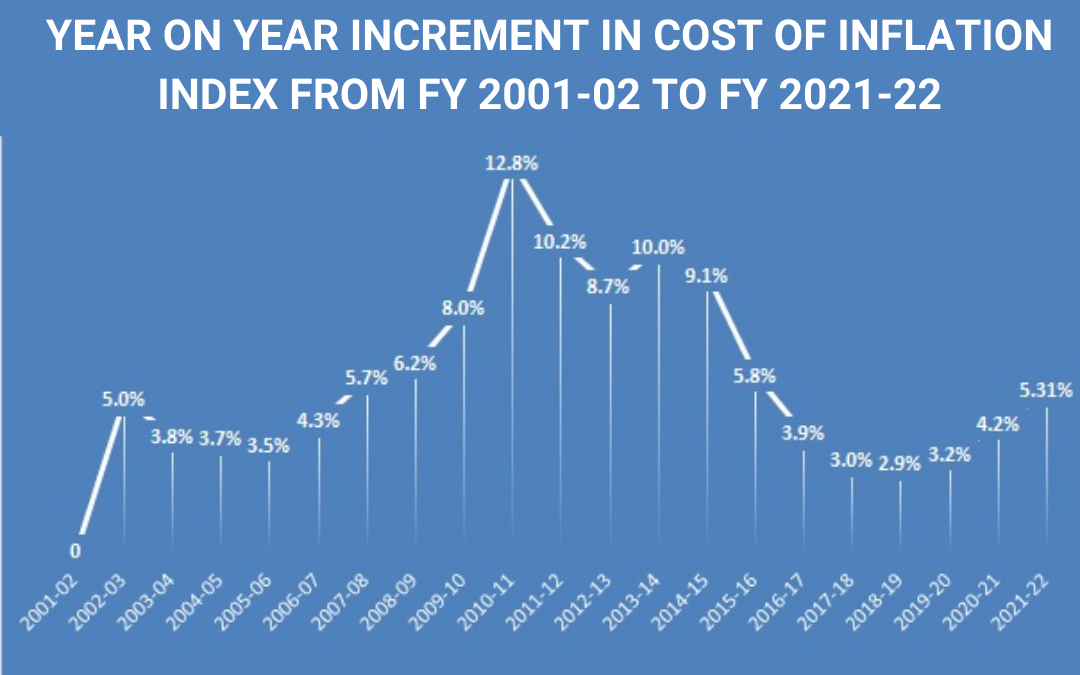

For example, many of you think that whatever you save during your working life will be sufficient for your sunset years. But have you accounted for the demon that goes by the name of inflation, which nibbles away the value of your money 24X7? Probably not. This means you will not save enough to be able to continue your present lifestyle in old age.

The first question that you may have when it comes to your retirement is

Where to invest for retirement?

When it comes to the accumulation of retirement corpus, people generally play safe and go for fixed interest-bearing risk-free instruments like fixed deposit, or PPF which at best give 8% return (in current market conditions, you are making only 7% there). But as retirement planning is for the longer term, one should take equity exposure to get a better return, which will help you accumulate a bigger corpus by retirement.

Equity can give you a 15% return on an average where you stay invested in it for a longer period of time to reduce the risk of volatility. A portion of the equity in your portfolio is a must. It is where wealth creation happens and it is what will also help you to achieve your corpus. We do not mean to suggest that you should invest 100% in Equity or 100% in Debt, you should invest in asset classes based on your risk profile and goals. Retirement being a long-term goal, one can invest some amount for it in Equity to enjoy the returns and manage the risk of it as well.

Let's understand How do you Invest - Basic Actionable Points?

- Invest in Debt for Short term goals

- Invest in a mix of Debt & Equity for long term goals (more than 3 years)

- Now, this mix of debt and equity is determined based on your risk profile. You can take your risk profile test here - Risk Calculator

This test will help you determine how much risk you are comfortable taking and guide you to invest based on that, rather than investing all your money in equity and having sleepless nights.

You can read more about this here: How should you invest

For the purpose of understanding this working and your goal to achieve a corpus of 5 crores with an income of 1 lakh, let's assume that our investor’s profile is a GROWTH profile and he is going to invest in equity and debt. His Debt-Equity Mix will be 30% debt and 70% equity.

How much you need to invest every month to accumulate Rs 5 crore

Now let's come to the main question - HOW MUCH?

The amount you need to invest to accumulate a corpus of Rs 5 crore will depend on your current age and the age that you want to retire. (i.e. your time to retire)

For example, (where your risk profile is a growth profile) and your current age is 25 years and you want to retire at the age of 55 years then you need to save Rs 11,694 every month for the next 30 years to accumulate Rs 5 crore. This is assuming an annual return of 12.90% (which is derived based on the asset allocation of your risk profile of GROWTH).

The required amount will go up to Rs 13,335 if you start one year later at the age of 26. Similarly, if you delay it by five more years, then you will be required to invest Rs 22,656 every month to accumulate the same amount. The required amount increases drastically with a delay in investment as the effect of compounding reduces.

Here is an illustration of how much you need to save every month to accumulate Rs 5 crore by retirement assuming that your investment grows at an annual rate of 12.90%.

However, if you are young and starting out, it is important to know that you do not need a lot of investments to reach 5 crores - just INR 11,000 is good to begin with, which is not a lot of money - given the time and funds involved. It definitely seems like an achievable goal.

Worth mentioning here is that you also need to create an emergency fund and your insurance as well as medi claim along with your regular investment for retirement so that your retirement corpus remains untouched in case of emergencies like job loss, hospitalization, or any pandemic that we are witnessing now, which can create potential risk to employment. Also, you may have many goals that may come and go as your life goes o, but your retirement will always be THE MOST important goal.

Do not forget that 'Retirement is that one goal you will never get a loan for, you have to plan for it all by yourself'