In the current situation, many people have experienced salary cuts or even job loss. During such trying times, an emergency fund can come handy and help you tide over such situations with relative ease. However, you don’t have to wait for an economic rebound to begin saving money. Even if you’re already facing income disruption or financial hardship, you can begin setting aside cash for the future.

Here is a quick guide on how to best make your emergency fund work for you.

Why have an emergency fund?

An emergency fund is like the fire extinguisher you keep at home. You hope you’ll never have to use it—but when there’s a need, you’re glad it’s there.

While you can plan for some foreseeable expenses, an emergency fund can help you manage all unplanned expenses efficiently. The current pandemic is an example of one such unplanned expense.

Here are a few cases in which you might dip into your emergency savings:

- Job or income loss

- Medical emergencies

- Unexpected home repairs

- Car maintenance

- Family emergencies

- Unanticipated travel (not your yearly leisurely travels)

So, how much emergency fund is needed?

Aim to have enough in a savings account to cover 6 months of expenses.

Everyone’s situation is different, so you can adjust that number based on your circumstances. Before calculating the amount of the emergency fund you need, it is important to calculate the minimum amount you need to get through the unavoidable monthly expenses.

This should include house rent, loan installments, utility bills, etc. Ensure that you don’t include avoidable expenses like movies, travel, etc. in this amount.

However, it is most critical to know where to park your emergency fund as the amount invested should not go down either and must deliver excellent returns. So, you must design it specifically to meet your contingencies.

Where should you invest your emergency fund?

Some of the options available to you are:

- Fixed Deposit: It is highly liquid and if you decide to withdraw before maturity, you can have cash deposited to your saving account. Your FD should be linked to your net-banking.

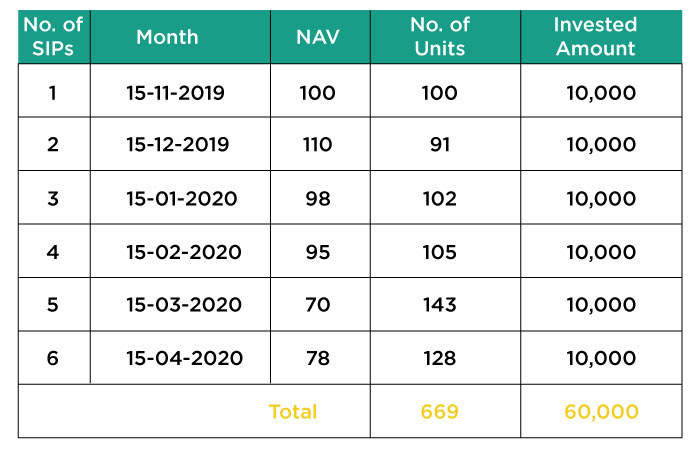

- Liquid Mutual Funds - They are considered to be safer than other debt instruments. Many liquid funds allow redemption of up to INR 50,000 or 90% of the invested amount. You can redeem any time. However, you need to remember that withdrawal may take 1-3 days for funds to be credited in your bank..

- Cash at Home - Cash can be your biggest protection against any emergency or any circumstances in which you cannot withdraw money from the bank. You should have up to 1 month’s expenses as cash for super sudden need!

Considering the fact that each of these investment avenues behaves differently, it might be good to split up your emergency funds among them based on your comfort level.

Where you should not park your emergency fund?

- Equity: Never park your emergency fund in equity as the market is volatile. It would be unfortunate to have to sell an investment at a loss to access your emergency fund.

- EPF/PPF/ELSS: The number one rule of your emergency fund cash is that it should be money you can easily access in a pinch. Anything that has a lock-in period does not qualify; money in your Public Provident Fund (PPF), Employee Provident Fund (EPF) or Equity Linked Saving Scheme (ELSS) cannot be part of your emergency fund.

- Real Estate: Even if you have crores of money in real estate it is impossible to generate emergency funds out of it due to illiquidity.

Therefore, the emergency fund is a personal insurance policy and not a wealth builder. The money must be easily accessible to you and your immediate family, or it may defeat the purpose if you are elsewhere or hospitalized and cannot access it. Safety and liquidity are the only two parameters that should be taken into account.

Wealth Cafe advice

Emergency fund is like your parachute that saves you from a freefall in the event of a financial crisis. So, always give it the importance it deserves.

It would be useful to keep reviewing your emergency fund requirements at least once a year, as there may be changes in your life like starting out a business, taking a sabbatical from work, addition of a new family member or a change in your lifestyle.

Check out our course NM101: Maximise your savings - to learn how to manage your money and get started with savings.

You can also enroll to NM 102: Build a Safety Net - to learn more about emergency funds and insurances