One of the most common themes of discussion about Mutual Funds is – When it is a good time to invest? While answers to this question are readily available, a relatively less discussed theme is – When is a good time to exit your Mutual Fund investments?

If you have been paying those SIP installments over a period of time, chances are that at some point, you would have asked yourself whether you should discontinue the payments.

So what are the triggers that should prompt you to exit from mutual funds or stop your SIP? In this blog, we will discuss specific instances of when you should consider exiting from your Mutual Fund investments and also how to come up with a viable exit strategy that works for you.

Things To Know Before You Exit the Fund

It’s essential to choose your alternatives before you exit a fund. You need to ensure that the new fund is in sync with your needs. For instance, if you had invested in large-cap funds because they are less risky and find that your fund has now been merged with a mid-cap fund, then you can redeem the combined fund for a fund composed of pure large-cap units only.

Along with this, you also need to take the LTCG (Long-Term Capital Gains) tax into account and see to it that the exit and redemption do not cause you huge losses.

Know when to exit from investments in mutual funds

Sometimes even during your goal period, there might be instances demanding you to exit from investments. In such scenarios, exiting the investment is suggested only when:

- When you achieve your financial goal

The basic reason you invest is to achieve your goals and if your goals are achieved or are at the stage where you need the money for the goal, you exit the fund. It is very simple right. However, your debt: equity allocation would tell a different story. If you had invested in a long-term goal say your kid's education of 15 years then you start exiting equity in the 12th year when it becomes a short-term goal and switch your money to liquid debt funds (safer options). From this debt fund, you redeem your units as and when you need money for the goal. Now after the 12th year you are sure that you will have money whenever you will need it for your child’s education. You no longer have to continue to invest after the 15th year. This is the most important reason or timing to exit the fund.

- Consistent poor performance of the fund

If a scheme has underperformed consistently versus its category peers over the past several quarters, you should consider exiting the scheme in favor of a more consistent performer. There can be many reasons behind your fund’s dipping performance.

It might have taken exposure to an unsuitable sector or theme at an inappropriate time. In yet another case, your debt fund might have invested in low-credit-rated securities and failed to earn high returns as planned.

Therefore, in order to gain the benefits, the mutual fund's investments should be tracked regularly. The performance of the mutual funds has to be seen in the right way. Following are some of the measures:-

- Compare your fund with the benchmark index

- Compare with the category average

- Fund level changes are making you uncomfortable

This is quite a common problem. For example, the fund manager who was doing a wonderful job for the last 10 years may have moved on. Occasionally, the AMC gets sold to a new fund manager and you may be uncomfortable with the strategies of the fund. There are also occasions when the fund may have made some changes to the objectives of the fund or its asset mix which may be incongruent with your goals. These are again genuine cases for you to terminate your SIP or exit from the particular scheme. You can look for other funds that are consistent with your objectives.

- To Rebalance Your Investment Portfolio

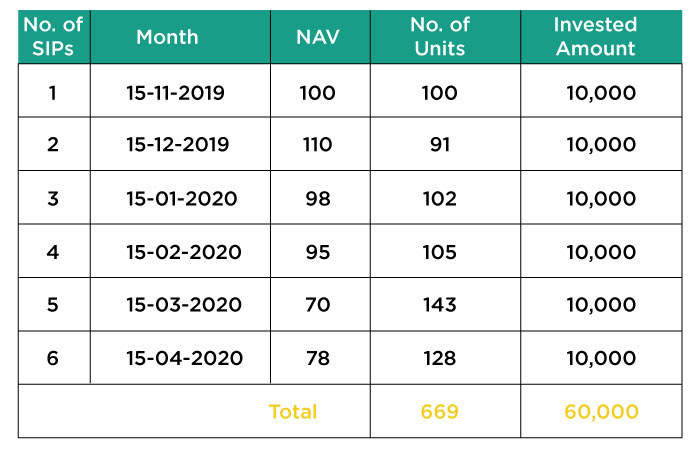

Rebalancing and asset allocation are crucial parts of your investment strategy. 90% of your returns are determined from your rebalancing rather than the exact fund you invested in. For instance, when you started investing your asset allocation was 70:30 into equity and debt. After completion of one year, your target allocations might have skewed. It might be the result of the recent rally increasing NAV of the equity component of the portfolio.

Or, in another case, a macroeconomic policy shift may have made large-cap stocks more favorable over others. All of these would trigger a portfolio rebalancing. In this, you sell those funds which have become irrelevant in the current context. You invest that money in other funds which look more favorable.

Ideally, SIPs should be investments in perpetuity. However, like all investments, one must review, re-balance and reset portfolios in line with current requirements and their risk appetite (which are always changing)

- The fund is all over the media for the wrong reasons

Let us start with a caveat here! Not everything that appears on the media or social media needs to be entirely believed. They must be taken with a pinch of salt. But when you see consistent negative cues like SEBI investigations, penalties imposed, customer dissatisfaction, services issues, allegations of circular trading, etc, there is obvious room for worry. Random media reports are understandable. However, do your own research that if you find such news temporary and you have the risk of holding on, you could consider not selling. Just the media news cannot be a reason, otherwise, you will be changing your portfolio every 6 months.

- There is an emergency

In case of financial emergencies, when your emergency fund isn’t sufficient to meet your requirement, you need to consider exiting your mutual fund investments. Therefore, funds should be parked in liquid funds for contingencies like emergencies.

If not for the above reasons, holding your investments for longer durations is always suggested. Along with an investment plan, always have an exit strategy ready for your investments.

Always remember why you invested in a particular fund (and please may that not be ‘best funds of 2020’). Once you map your investments to your goals, these questions will not be very difficult for you to answer. As you exit when your goals are due or only when something gravely is wrong with the fund. Otherwise, it is Janam Janam ka Saath (especially in equity funds).

Hence, we always recommend learning about goal setting and investing properly to achieve your goals - check our course- NM 104: Basics of Mutual Funds