As the name itself suggests, it is an exemption for allowance/assistance received by the employee from his employer for travelling on leave. Though it sounds simple, many factors need to be kept in mind before planning the trip to claim an LTA exemption. Income tax provision has laid down rules to claim exemption of LTA.

Frequently Asked Question

Q1. How much can I claim tax exemption in Leave Travel Allowance or LTA?

A. The amount of LTA exemption depends on the LTA component in your compensation package or CTC. You can furnish proof of travel within the block period and claim up to the amount prescribed in your CTC.

Q2. What is the latest block period to claim LTA exemption?

A. The latest block period of four years is from 1 January 2018 until 31 December 2021.

Q3. How many trips can I make in one year to claim the exemption?

A.You can claim LTA exemption only for one trip in one calendar year.

Q4. Can we carry forward unclaimed LTA?

A. Yes. An employee can carry forward one trip to the next block year. This means in 4 block years, he can claim one trip and one trip he can carry forward to the next block year. During the next block year, instead of 2 trips, they can undertake 3 trips and claim LTA benefits. However, this has to be communicated to an employer so that they can make provisions in their books.

Q5. Can I claim an LTA benefit for the travel costs of my family?

A. You can claim LTA benefit for the travel costs of yourself, your family consisting of your spouse, children, dependent parents, brothers, and sisters of the employee.

Q6. How many kids are eligible to travel to get an LTA benefit?

A. 2 kids are eligible to travel to get LTA benefits. In case there is a triplet kid, due to twins, such twins would be considered as one kid for this purpose.

Q7. If an employee does one trip but visits multiple places, is he eligible to claim LTA?

A. The income tax rule indicates that LTA can be claimed for the shortest distance between the starting point and farthest point. In between, if there are more places to visit, you can do that.

Q8. Can I claim LTA by travelling abroad?

A. LTA can be claimed for travel taken within India. You cannot claim foreign trip expenses for LTA benefits.

Q9. What mode of travel is eligible for claiming LTA?

A. In the case of air travel, economy class is eligible.

In the case of train travel, up to the first AC is eligible.

In the case of road transport, a rented vehicle/bus of any kind is eligible to claim LTA benefit.

Q10. If an employee travels at the end of the year and returns from a trip which falls beyond 31st Dec, how does it work?

A. In such cases, employees need to consider the starting date as a basis and claim for that calendar year.

Q11. If an employee travels at the end of the block year and returns from a trip after 31st Dec which falls in a different block year, how does it work?

A. Block year for the current LTA period is from 1-Jan-2018 to 31-Dec-2021. Assume that you want to claim your 2nd LTA amount and plan your trip from say 25th Dec 2021 to 5th Jan 2022. Since 1-Jan-2022 onwards is a different block period, you can still claim this trip under the 2018-2021 block period.

Q 12. I missed submitting my first LTA claim in a block year. Can I submit 2 LTA claims in a block year later?

A. As per IT Rules, an employee needs to claim 2 trips LTA in a block of 4 years. However, if you have missed a claim in the first 2 years, you need to indicate this to your employer, so that they can carry it forward to the subsequent 2 years of the same block year. You can later submit the bill of the first 2 years (bill date should indicate that) and claim it. However, you cannot claim 2 trips expenses in the subsequent 2 years of a block period (with bill dates of the 3rd and 4th year of a block period).

Q13. Do I need to submit a single bill for our trip or multiple bills would be accepted for LTA?

A. LTA benefit is given for a trip. This means, one family is travelling. Ideally, there would be one bill. However, there are cases where multiple bills would be received for a single trip (for airfare bills, where a family member agreed to join later and the booking was made later, but the travel date is the same for the remaining members). In such cases, these are agreed upon by employers. It would be better to check with your employer in such circumstances before proceeding further.

Q 14. How can we claim LTA even without travelling?

A. Due to the Covid-19 pandemic, many people are not in a position to travel with family, and, therefore, LTA can be claimed even without travelling. For claiming the LTA exemption,

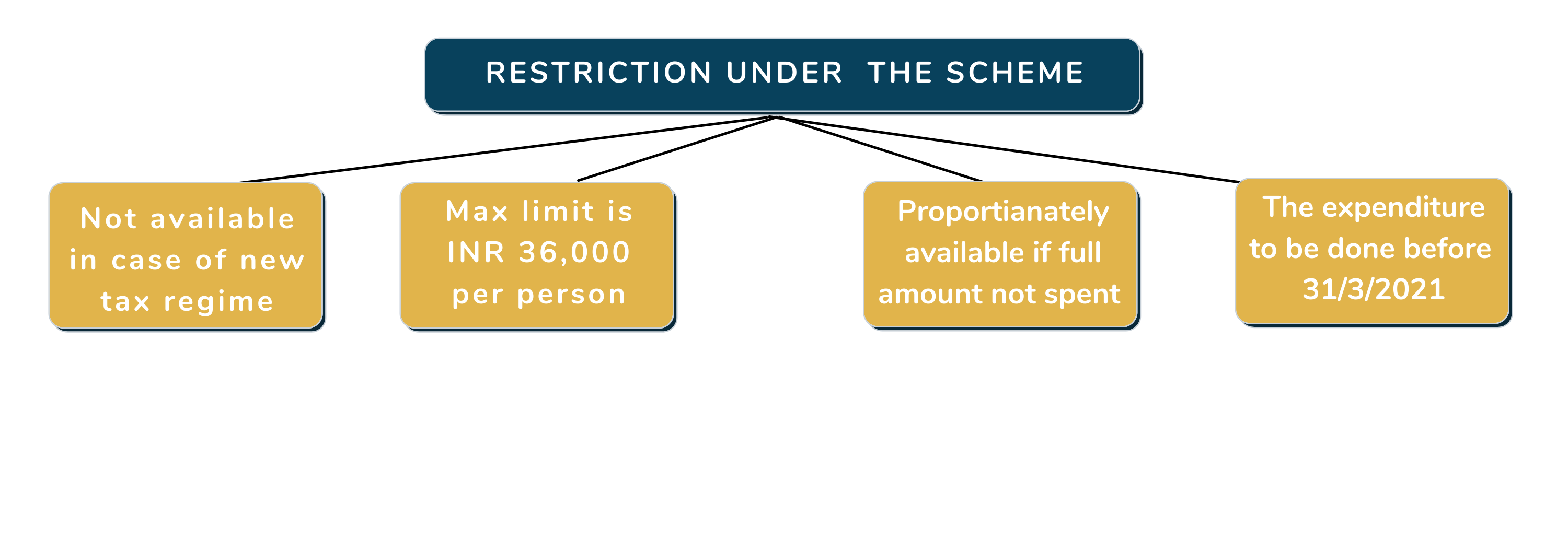

Conditions to be fulfilled for claiming LTA exemption under the scheme

- 3 times the amount of LTA earned to be spent

- Goods and Services to be purchased from registered GST dealer

- Payments to be done only through digital modes

- All Invoices of the purchase has to submit to the employer