Buying and owning real estate is an investment strategy that can be both satisfying and lucrative. It is said that one has to strip naked financially to invest in a house - and if you are going through the same - you can join us on 28th May 2022 where we shall help you in your dream of buying a house.

However, if you already own a house and wish to sell it - no matter what your reason is - tax is levied on the same depending on the asset type and the duration you hold it for.

Firstly, let us understand which portion of the income is taxable on sale of real estate. Tax is payable on the profits you earn from selling the real estate - i.e. cost of acquisition - sales proceeds.

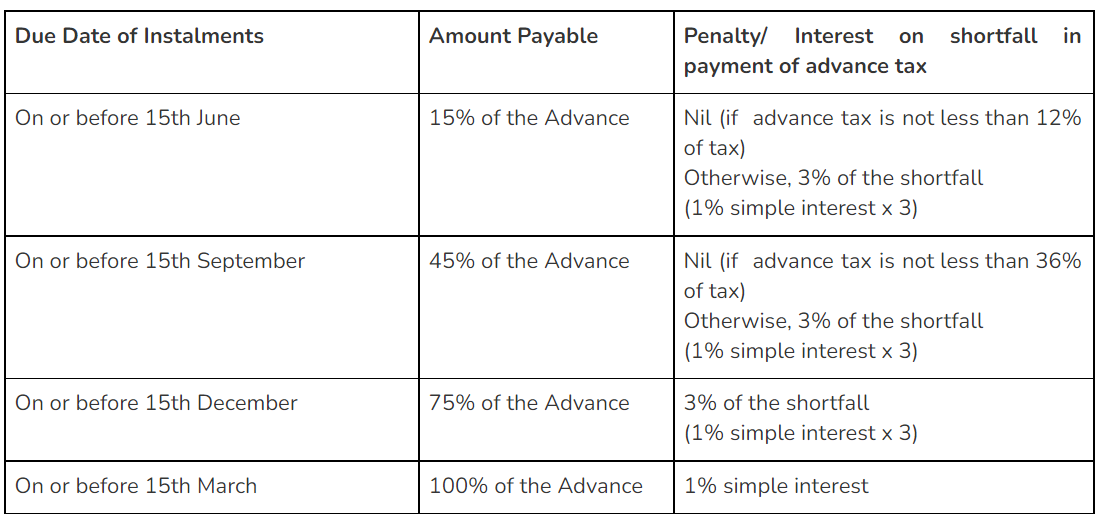

| Nature of Tax | Short-term capital gains Tax | Long-term capital gains tax |

| Period of Holding | held for less than 24 months | held for 24 months or more |

| Tax applicable | as per the Income Tax Slab Rates | 20% |

Now before we jump directly on how you can save your taxes - let us first understand the various types of real estate that you can own:

- Residential Property: This is one of the most popular ones-such properties fill one of the basic human needs as well as reflect your dearest aspirations. Both reconstruction and resale homes are included in residential property.

- Commercial Property: Commercial property includes vacant land for commercial use or existing business buildings. Office spaces, showrooms, retail outlets and warehouses are just a few examples of such properties

- Agricultural/Open Land: Agricultural land is typically land devoted to agriculture - you cannot use this land to build residences unless the government grants you permission to do that. Under the provisions of the law in India, fertile agricultural land could only be used for agricultural purposes and nothing else.

Now that you understand the various type of property - let’s check some of the ways in which you can save your taxes from the sale of your property:

1. Under Section 54:

Section 54 of the Income Tax Act allows the lower of the two as exemption amount:

- Amount of capital gains on transfer of residential property, or

- The investment made for constructing or purchasing new residential property

You can avail this exemption by selling a residential property, which is a long term capital asset and buying another residential house property only. You cannot benefit from this in the case of the sale of commercial property or agricultural land. Only the balance amount from the capital gains (if any) will be taxable at 20%. However, you can save tax on that as well by reinvesting the remaining amount under section 54EC within six months of transfer subject to other conditions to save tax (discussed below).

Also, you should have necessarily purchased a residential house either two years after the date of transfer/sale or one year before the date of transfer/sale and in case the house is under construction – the time limit is 3 years from the date of sale. You cannot purchase any residential house out of India to claim an exemption under this section.

You can club capital gain from multiple properties to buy one property but you cannot invest capital gain from a single property to buy multiple properties. However, as an exception to this rule, the purchase or construction of two residential houses is allowed only if the gain is less than INR 2 crore. But, you can exercise this option only once in a lifetime. For all other years, investment should be made in the construction/ purchase of 1 residential house only.

2. Under Section 54EC:

Section 54EC states that if the profit made on the sale of Land or Building (whether Residential or Non-Residential) – is invested by you in ‘long-term specified assets within 6 months of the sale, then the capital gains are exempt from taxation.

The ‘long-term specified assets’ referred to above are Capital Gain Bonds issued by the government organisations like the National Highway Authority of India and Rural Electrification Corporation. These bonds are AAA-rated with an interest rate of approx 5.25% p.a. The Principal invested becomes tax-free after the lock-in period but the interest continues to remain taxable.

The maximum that you can invest in these bonds is Rs. 50 lakhs and the investment comes with a lock-in period of five years.

You may want to buy capital gain bonds only if the amount you have made as capital gains is low. If the amount is large enough to buy or build a house, the residential property would be a better investment because of greater capital appreciation.

3. Under Section 54B

No Capital Gains will arise on the sale of Agricultural Land situated in a Rural Area as it is specifically excluded from the definition of Capital Asset. However, Capital Gains will arise on the sale of Agricultural Land situated in a Non-Rural Area. Nevertheless, the exemption can be claimed from such Capital Gains under Section 54B. Under this section, capital gains, both short-term and long-term, that arise from the transfer of agricultural land into another agricultural land are exempt from Income Tax.

This benefit is available only to an individual or a HUF. Also, to benefit from this exemption the land should be used for the agricultural purpose at least for two years. If the cost of new Agricultural Land is equal to or greater than capital gains, then entire capital gains are exempt. Moreover, if the cost of new Agricultural Land is less than capital gains, capital gains to the extent of the cost of new agricultural land are exempt.

Can a capital gain tax exemption get reversed?

You can avoid paying the capital gains tax on the property if you reinvest the amount in a new property. But, the exemption will sustain if you hold the new property for at least two years. If you sell the property before 24 months, the exclusion will be reversed, and you would be liable to pay the capital gains tax that was exempted earlier.

Wealth Cafe Advice:

If you are unable to reinvest the gains in another house or bonds before filing your tax return for the year in which the sale took place, deposit the balance in the Capital Gains Account Scheme so that you are eligible for the deduction. Capital Gains Account Scheme (CGAS) allows you to safeguard your long-term capital gains until you are unable to invest them in a house before the due date for filing an income tax.